Want to know Certleader AHM-520 Exam practice test features? Want to lear more about AHIP Health Plan Finance and Risk Management certification experience? Study Precise AHIP AHM-520 answers to Leading AHM-520 questions at Certleader. Gat a success with an absolute guarantee to pass AHIP AHM-520 (Health Plan Finance and Risk Management) test on your first attempt.

Check AHM-520 free dumps before getting the full version:

NEW QUESTION 1

The following statements are about the option for health plan funding known as a self- funded plan. Select the answer choice containing the correct response:

- A. In a self-funded plan, an employer is relieved of all risk associated with paying for the healthcare costs of its employees.

- B. Self-funded plans are subject to the same state laws and regulations that apply to health insurance policies.

- C. Employers electing to self-fund a health plan are required to pay claims from a separate trust established for that purpose.

- D. An employer electing to self-fund a health plan has the option of purchasing stop-loss insurance to transfer part of the financial risk to an insurer.

Answer: D

NEW QUESTION 2

Under the doctrine of corporate negligence, a health plan and its physician administrators may be held directly liable to patients or providers for failing to investigate adequately the competence of healthcare providers whom it employs or with whom it contracts, particularly where the health plan actually provides healthcare services or restricts the patient's/enrollee's choice of physician.

- A. True

- B. False

Answer: A

NEW QUESTION 3

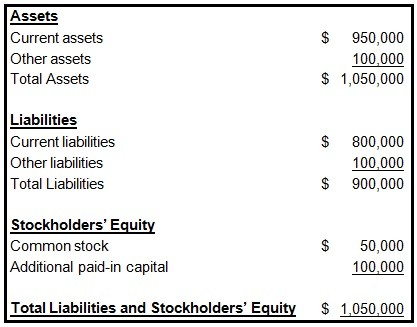

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

- A. Cash by its reported claims only

- B. Cash by its reported claims and its incurred but not reported claims (IBNR)

- C. Reported claims by its cash

- D. Reported claims and its incurred but not reported claims (IBNR) by its cash

Answer: B

NEW QUESTION 4

The following statements are about federal laws and regulations which affect health plans that offer products and services to the employer group market. Select the answer choice containing the correct statement.

- A. Amendments to the HMO Act of 1973 require federally qualified HMOs to adjust a group's prior premiums on the basis of the group's experience during the prior rating period.

- B. The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1986 requires that, if a plan sponsor elects to terminate its group coverage with a health plan, then the health plan must continue its coverage for the COBRA-qualified beneficiaries in the group.

- C. The Health Insurance Portability and Accountability Act (HIPAA) of 1996 generally requires the guaranteed renewal of healthcare coverage for certain individuals and for both small and large groups, regardless of the health status of any member.

- D. The Mental Health Parity Act (MHPA) of 1996 mandates that all health plans must offer benefits for mental healthcare.

Answer: C

NEW QUESTION 5

One true statement about a type of capitation known as a percent-of-premium arrangement is that this arrangement

- A. Is the most common type of capitation

- B. Is less attractive to providers when the arrangement sets provisions to limit risk

- C. Sets provider reimbursement at a specific dollar amount per plan member

- D. Transfers some of the risk associated with underwriting and rating from a health plan to a provider

Answer: D

NEW QUESTION 6

The McGwire Health Plan is a for-profit health plan that issues stock. Events that will cause the owners' equity account of McGwire to change include

- A. McGwire's retention of net income

- B. McGwire's payment of cash dividends on the stock it issued

- C. McGwire's purchase of treasury stock

- D. All of the above

Answer: D

NEW QUESTION 7

The Eclipse Health Plan is a not-for-profit health plan that qualifies under the Internal Revenue Code for tax-exempt status. This information indicates that Eclipse

- A. Has only one potential source of funding: borrowing money

- B. Does not pay federal, state, or local taxes on its earnings

- C. Must distribute its earnings to its owners-investors for their personal gain

- D. Is a privately held corporation

Answer: B

NEW QUESTION 8

The Acorn Health Plan uses a resource-based relative value scale (RBRVS) to help determine the reimbursement amounts that Acorn should make to providers who are compensated under an FFS system. With regard to the advantages and disadvantages to Acorn of using RBRVS, it can correctly be stated that

- A. An advantage of using RBRVS is that it can assist Acorn in developing reimbursement schedules for various types of providers in a comprehensive healthcare plan

- B. An advantage of using RBRVS is that it puts providers who render more medical services than necessary at financial risk for this overutilization

- C. A disadvantage of using RBRVS is that it will be difficult for Acorn to track treatment rates for the health plan's quality and cost management functions

- D. A disadvantage of using RBRVS is that it rewards procedural healthcare services more than cognitive healthcare services

Answer: A

NEW QUESTION 9

The Column health plan is in the process of developing a strategic plan.

The following statements are about this strategic plan. Three of the statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

- A. Human resources most likely will be a critical component of Column's strategic plan because, in health plan markets, the size and the quality of a health plan's provider network is often more important to customers than are the details of a product's benefit design.

- B. Column's strategic plan should only address how the health plan will differentiate its products, rather than where and how it will sell these products.

- C. Column most likely will need to develop contingency plans to address the need to make adjustments to its original strategic plan.

- D. Column's information technology (IT) strategy most likely will be a critical element in successfully implementing the health plan's strategic plan.

Answer: B

NEW QUESTION 10

The Marble Health Plan sets aside a PMPM amount for each specialty.

When a PCP in Marble's provider network refers a Marble plan member to a specialist and

the specialist provides medical services to the member, the specialist begins to receive a share of those funds on a monthly basis. Marble determines the monthly payment for each specialist by dividing the number of active patients for that specialty by the total specialty pool for that month.

This form of payment, which is similar to a case rate, is known as

- A. Referral circle capitation

- B. Risk pod capitation

- C. Contact capitation

- D. Retrospective reimbursement capitation

Answer: C

NEW QUESTION 11

The Harp Company self-funds the health plan for its employees. The plan is administered under a typical administrative-services-only (ASO) arrangement. One true statement about this ASO arrangement is that

- A. This arrangement prevents Harp from purchasing stop-loss coverage for its health plan

- B. The amount that Harp pays the administrator to provide the ASO services is not subject to state premium taxes

- C. The administrator is responsible for paying claims from its own assets if Harp's account is insufficient

- D. The charges for the ASO services must be stated as a percentage of the amount of claims paid for medical expenses incurred by Harp's covered employees and their dependents

Answer: B

NEW QUESTION 12

A product is often described as having a thin margin or a wide margin. With regard to the factors that help determine the size of the margin of a health plan's product, it can correctly be stated that the

- A. greater the risk a health plan assumes in a health plan, the thinner the product margin should be

- B. more that competition acts to force prices down, the wider the product margins tend to become

- C. greater the demand for the product, the thinner the margin for this product tends to become

- D. longer the premium rates are guaranteed to a group, the wider the health plan's margin should be

Answer: D

NEW QUESTION 13

If the Ascot health plan's accountants follow the going-concern concept under GAAP, then these accountants most likely

- A. Assume that Ascot will pay its liabilities immediately or in full during the current accounting period

- B. Defer certain costs that Ascot has incurred, unless these costs contribute to the healthplan's future earnings

- C. Assume that Ascot is not about to be liquidated, unless there is evidence to the contrary

- D. Value Ascot's assets more conservatively than they would under SAP

Answer: C

NEW QUESTION 14

The Lighthouse health plan operates in a state that allows the health plan to use an underwriting method of determining a group's premium in which underwriters treat several small groups as one large group for risk assessment purposes. This method, which helps Lighthouse more accurately estimate a small group's probable claims costs, is known as

- A. Case stripping

- B. The low-option rating method

- C. The rate spread method

- D. Pooling

Answer: D

NEW QUESTION 15

Variance analysis is the study of the difference between expected results and actual results. Variances can be positive or negative. A positive variance is typically considered:

- A. favorable for both expenses and revenues

- B. favorable for expenses, but unfavorable for revenues

- C. favorable for revenues, but unfavorable for expenses

- D. unfavorable for both expenses and revenues

Answer: C

NEW QUESTION 16

One law prohibits Dr. Laura Cole from making a referral to another provider entity for designated health services if Dr. Cole or one of her immediate family members has a financial relationship with the entity. This law is known as the

- A. safe harbor law

- B. upper payment limit law

- C. anti-kickback law

- D. physician self-referral law

Answer: D

NEW QUESTION 17

......

Recommend!! Get the Full AHM-520 dumps in VCE and PDF From Dumpscollection.com, Welcome to Download: https://www.dumpscollection.net/dumps/AHM-520/ (New 215 Q&As Version)